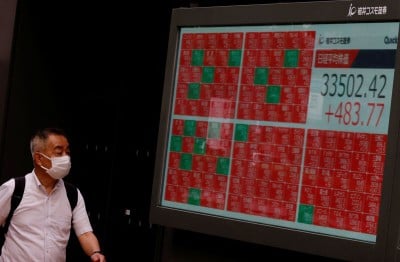

© Reuters. FILE PHOTO: A man looks at an electric board displaying the Nikkei stock average outside a brokerage in Tokyo, Japan June 14, 2023. REUTERS/Kim Kyung-Hoon/File Photo BAC +2.33% Add to/Remove from Watchlist Add to Watchlist Add Position

© Reuters. FILE PHOTO: A man looks at an electric board displaying the Nikkei stock average outside a brokerage in Tokyo, Japan June 14, 2023. REUTERS/Kim Kyung-Hoon/File Photo BAC +2.33% Add to/Remove from Watchlist Add to Watchlist Add Position Position added successfully to:

+ Add another position Close GS -1.60% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close MS +2.03% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close USD/JPY -0.01% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close US500 -0.01% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close JNJ -0.91% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close NFLX -1.41% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close TSLA +0.39% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close DE10Y... +0.07% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close US10Y... -0.23% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close EUR/USD -0.10% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close

By Stephen Culp

NEW YORK (Reuters) - The Nasdaq dipped and benchmark U.S. Treasury yields surged on Tuesday as robust economic data and strong third-quarter earnings suggested the Federal Reserve may keep policy tight for longer than expected.

All three major U.S. stock wavered throughout the session but the S&P 500 and the Dow closed essentially flat, while interest rate-sensitive megacap stocks weighed on the Nasdaq, which posted a modest loss.

Chip shares came under pressure after President Joe Biden's administration announced plans to halt shipments to China of more advanced artificial intelligence chips.

The Philadelphia SE Semiconductor index slid 0.8%.

Consensus-topping retail sales data along with solid profit beats from Bank of America and Goldman Sachs added to a growing mountain of evidence that the U.S. economy is chugging along despite the Fed's inflation-fighting interest rate hikes.

Yields on two-year Treasury notes rose to 17-year highs with five-year yields at 16-year peaks.

"The retail sales report was quite strong, and definitely an indication that the consumer is doing well," said Thomas Martin, senior portfolio manager at GLOBALT in Atlanta. "So the question is, how does the market react to that? Is good news good news or is good news bad news?"

"You're seeing a little bit of confusion there because while it probably shouldn't affect the Fed's calculus, you never know," Martin added.

Market participants were also watching the humanitarian crisis arising from the Israel-Hamas conflict as Biden heads to the region.

The Dow Jones Industrial Average rose 13.11 points, or 0.04%, to 33,997.65, the S&P 500 lost 0.43 points, or 0.01%, to 4,373.2 and the Nasdaq Composite dropped 34.24 points, or 0.25%, to 13,533.75.

European stocks dipped as a spate of downbeat earnings and higher government bond yields offset rising energy shares and waning concerns over Middle East turmoil.

The pan-European STOXX 600 index lost 0.10% and MSCI's gauge of stocks across the globe gained 0.15%.

Emerging market stocks rose 0.48%. MSCI's broadest index of Asia-Pacific shares outside Japan closed 0.54% higher, while Japan's Nikkei rose 1.20%.

Benchmark Treasury yields spiked after the strong retail sales data led market participants to adjust their expectations regarding the duration of the central bank's tightening cycle.

Benchmark 10-year notes last fell 31/32 in price to yield 4.8383%, from 4.71% late on Monday.

The 30-year bond last fell 30/32 in price to yield 4.9323%, from 4.866% late on Monday.

The greenback oscillated against a basket of world currencies, rising against the Japanese yen and ending lower against the euro amid the unfolding Middle East drama and as market participants braced themselves for speeches by central bank officials.

The dollar index fell 0.03%, with the euro up 0.15% to $1.0574.

The Japanese yen weakened 0.18% versus the U.S. dollar at 149.79 per dollar, while sterling was last trading at $1.2184, down 0.26% on the day.

Crude prices moved sideways as traders waited for Biden's impending visit to Israel to see if diplomatic efforts will prevent the conflict Middle East from widening.

U.S. crude settled unchanged at $86.66 per barrel while Brent settled at $89.90, up 0.28% on the day.

Gold prices steadied as the safe-haven metal benefited from mounting geopolitical uncertainties.

Spot gold added 0.1% to $1,922.16 an ounce.

(This story has been refiled to fix a typo in paragraph 1)

Wall St ends mixed, US Treasury yields spike on robust data, solid earnings 2